發表於2011年3月26日

11. 1997年泡沫爆破,所以1996年賣樓

根據差餉物業估價署資料,香港2003年再對上一個樓市低谷是1984年第3季,指數是16.7(1999年=100,並非中原指數),而97年最高位發 生於10月,指數是172.9。即是說,假如有人在84年第3季買了一個16萬7千的物業,並在1997年以172萬9千放出,他的利潤是156萬2千。

很多淡友酸友也有一個極嚴重的誤解,就是「預知」2012~2013會泡沫爆破,就預早在2011賣樓等跌。打個比喻,1996年有人預知1997年爆, 先知先覺地在1996年賣樓。這些「先知」可以用高姿態話俾人聽佢一早估到樓市幾時爆,但實際上佢地既策略極為白痴,原因如下:

1996年1月的指數是105.2,即是說,如在那時賣樓,上面個案的例子可以有88萬5千的利潤,與1997年10月賣樓作比較,賺少了67萬7千。換 句話說,由1984至1997這13年間,樓市有43%的利潤是集中在1996~1997這2年之內,其中25%更是高度集中於1997年的頭10個月! 因此,即使先知有預知能力,卻沒有太大的賺錢能力,大部份的利潤也在最後關頭白白流走。預計下年爆但今年先賣樓,簡直不知所謂!

我們再睇睇在1996年賣樓的先知是什麼下場。1996年1月指數105.2,有個傻人唔聽先知話,在1998年7月才放,指數108,在泡沫爆破後差不多一年才放,竟然可以反勝先知!

咁究竟今次樓市幾時爆?我唔知。但我再次重申,樓市爆係因為大量業主供唔起樓要劈價賤賣,這是分析樓市的第一道重要定律。我假設聯儲局在2011年6月開 始加息,再每季加半厘(極瘋狂的假設),而香港銀行跟足,亦要2年時間才P=10厘。我就當佢2013年爆,睇完我上面的分析,各位師兄都應該明白 2011~2013這3年內我們應該做什麼。2011賣樓等跌,基本上等如自殺。

12. 境外有天災人禍,香港樓價會跌

先問大家一個問題:89年64事件,對於8年後就要回歸的香港來說,算不算大事?若算,那樓價應該跌多少?1成?2成?

事實上,89年第2季指數40.8,第3季跌至39.2,只微跌了3.9%,但去到第4季,已反升至41.4,64事件令到大量香港人走資移民,對前途信心盡失,但樓市就硬過鐵,輕輕微調後就一直上升至1995年才出現一次1成以上的向下調整。

一個直接影響香港前途的重大事件,對樓市的影響力只不過是3.9%。數據就是如此。若果有人覺得香港境外死人冧樓可以震散香港樓價,他正在發綺夢。

13. 銀行減優惠 = 加息

有酒家推出1蚊一隻雞吸客,後來改為2蚊一隻雞,消費者就投訴話做乜加價100%,通脹潮又黎。如此無理取閙的消費者,就正正等於那些將「H+1.2%」 稱為「加息」的人。對於供樓人士來說,加息的正確定義是P利率上調。H按由+0.7轉為+1.2,只能稱為「減優惠」,現時正在供樓的業主完全不受減優惠 政策的影響,何來加息?何來週期?

實際上,銀行減H按優惠,即強烈暗示「H+x.x%」中「H」的部份在可見將來沒有可能大幅抽升至啟動P的cap位,故只好向「x.x%」的部分動腦筋。 逆向思維,若銀行預計半年後同業拆息可以升至啟動cap位,那可大安旨意推出「H+0%」的超特惠plan「呃」人落搭,半年後立即啟動P的cap位賺個 痛快,為何要減優惠趕客?

14. 居屋 = 用市價7折買樓

居屋實際上並不是政府「補貼」業主,而是政府和業主「合資」購買物業,業主出7成,政府出3成。表面上業主好似好著數,「7折」就可以買到樓,但問題係負 責出其餘3成的那位股東很惡,不但限制業主的售樓對象,更封鎖業主一切(賣樓以外)產生利潤的可能,不可出租,即使供斷了亦不可加按。按道理來說,用7折 買了樓,應可以租俾人,再將3成分給「股東」,而股份佔7成的大股東,要加按融資冇理由要得到只佔3成股份的小股東同意,但事實上居屋就是一種如此荒唐的 系統。再者,買樓時就話7折,到賣樓時,補地價往往任佢up,可以去到樓價的1倍(即地價佔50%)都得。祥益的汪老闆分析得好好,不愧居屋專家之名,佢 話政府起居屋,冇乜人補地價政府其實有著數,因為政府持有的3成業權隨時間升值。事實上補地價是以現市價計,很明顯政府都係咁諗。

嚷要起居屋的人,眼光短淺,只看到買居屋時所謂「折扣」,忽略了業權完整的重要性。事實上只要買遠些少、細些少或舊些少,已經可以有7折,無需和政府這個惡股東「合資」買樓。

再者,居屋是發水最勁的物業種類,沒有露台、沒有大型會所、沒有工作平台,一梯10伙以上,但實用率卻只得8成甚至7成半,那20~25%的面積去了哪裡?

因此,居屋其實對市民有百害而無一利,嚷要起居屋的人,根本唔知乜野係居屋,或者這些人的目的只不過是想增加供應,方便自己買私人樓。

Gold and Silver Bull

Sunday, March 8, 2015

買樓誤解系列(2)

發表於2010年11月24日,即SSD生效後

1. 有利淡消息,業主一定要賤賣

我做過一個有趣實驗,各位可以跟我一齊做。我試下問公司幾個住公屋未買過樓既淡友,而家供樓利息係幾多,可能我既同事都係arm arm赤柱放監出黎,竟然冇人答得出,有一兩個就答3~4厘,最離譜的一個答5厘,但能夠答0.9~1厘既,係一個都冇。

沒有準確的利率訊息,當然會對市況作出錯誤的估計,亦不會知道現時業主的供樓壓力是何其低。我一再強調,市場出現大量劈價盤的原因是大量業主供唔起樓,只 要有能力供,業主會選擇一動不如一靜,因為賣了樓轉租同樣係支出,而且租金遠超實際利息支出,毫不化算。以我住的貧民區屯門市中心為例,月供6000,利 息佔1500,但租金就要1萬,即租金支出=利息支出的6倍左右。劈價賣樓後每月的財政壓力會大4000蚊。因此,自住樓的業主都會選擇繼續月供 6000,其中1500當係交租俾銀行,4500當係儲錢。

窮鬼業主係呢一刻反而冇能力劈價賤賣,唔係唔想劈俾你。

2. 炒家止賺就叫劈價

呢一兩日我有去地產舖問下有冇筍盤,結果係得個桔。唔係話冇業主減價,而係減完都仲比9月份個價貴,點入呀?

報紙仲搞笑,炒家入貨310萬,叫價410萬,新招後減到385萬就叫「劈」,足足叫高75萬,即原價的25%都叫「劈」!情況就好似一個次次考第一既高 材生,測完驗你問佢識唔識,佢話考得好差,你以為今次仲輪唔到你唔合格,點知一派試卷,先知高材生拿99分,99分係佢黎講叫考得好差。

而所謂撻訂其實係新入貨炒家眼見6個月內冇可能升15%以上,在沒有盈利希望的情況下離場止蝕。實際上真正用家在新招後都繼續買樓。

3. 所有業主都可以隨時劈4~5成賣樓

信不信由你,係呢一刻只得有錢佬才有能力劈價3成以上賣樓俾你。原因好簡單,劈價4成我就要抬1成樓價先可以貼錢賣層樓俾你,你欣賞我層樓我貼俾你冇乜所謂,但問題係好似我呢d咁既窮鬼真係冇幾十萬抬俾你。

抬錢賣樓既動機就係,借私人貸款的利息,比供樓利率低,抬完錢反而可以節省利息。但現在暫時供樓利率仲係低,抬錢賣樓冇乜著數,大家可能要等一等。

4. 全港業主PK,我可以獨善其身

很多淡友希望樓價跌,但目的唔係想趁低入貨,而係想睇業主PK,見到有人負資產燒炭食二手飯佢地就會亢奮,說穿了,其實就係心地唔好,損人不利己。

但話時話,如果有一日全港業主都PK,失業冇收入供唔起樓,淡友就可以全身而退做一個食花生既旁觀者?如果係咁天水圍公屋就唔會悲情。訓天橋底既陳伯就係天下最幸福的男人。

事實上,要全港業主一齊PK,香港經濟一定出現嚴重問題,全香港冇人可以冇事甩身。淡友想業主死,但淡友本身自己都要死,仲可能係死先過人。當然,淡友既目的唔係想改善自己生活,由頭到尾都只係想人地同佢一齊PK,所以只要有業主陪佢一齊燒炭佢就覺得賺左。

5. 我冇能力買樓,所以樓價太高

坦白講,我都唔明點解有人會用1萬蚊一呎買樓,但唔明還唔明,有人真係有本事買,首期俾4百萬,月供5萬都供得起,証明人地有本事搵錢多過我,我買唔到1萬蚊樓係我廢,而唔係樓貴。

一再強調,自願的價就係市價,就係合理價,買唔起係人既問題,唔係個價既問題。你唔係身處那個圈子/階層,你不會明白那個圈子階層的人一個月搵幾多,如果你用自己的能力去衡量別人的負擔,一定出錯。

6. 炒家撻訂,我有著數

好多淡友睇報紙見到炒家撻訂,覺得炒家抵死,心都涼晒。但可能佢地未買過樓唔知乜野叫撻訂,撻訂D錢去左邊個度又唔知,總之有人唔見錢就最 開心。事實上樓市係zero sum,有人賺錢就有人接貴貨,有人蝕錢就有人執筍野,d錢唔會唔見左,只係會由傻仔度轉移去叻仔度。炒家撻訂,一方面係炒家蝕錢,另一方面睇,係業主無 啦啦賺左,d錢唔會落入淡友或買家度,係全數落入業主及agent,我唔明白業主多左錢駛淡友點解會開心。現在情況係,一方面冇實力炒家撻訂,另一方面實 力用家、長線投資者創新高呎價,被撻業主錢多左,持貨力增強,個市更加難跌。呢一樣野未買過賣過樓係好難明白。長期淡友一定會誤解。坦白講,如果每次賣樓 買家都撻我訂,一年撻一次我已經可以退休唔駛返工。

另外,我做過agent可以講多一樣野俾大家聽,agent的其中一件工作,就係行家(另一間公司)做到成交後,會話俾業主聽賣平左,然後話俾買家聽買貴 左,撩佢地撻訂,保持客源盤源。更過份係,正常成交係2~3個月後俾佣,撻訂就即時俾,因此agent係有動機撩自己的客、業主撻訂。對於agent黎 講,最理想的環境就係每一單都有人撻訂。

7. 炒家會感到痛苦

任何一個在2009-2010年出入過3次貨既炒家,起碼賺100萬,同一時間持貨50件的大炒家,身家最少5~6億,單係2010年的收 入已經8位數字,呢d人既字典入面,只有幸福,沒有痛苦呢2個字。(美孚大炒家97,03,08乜都經歷過,有咩世面未見過?)點解人地撻40萬都撻得 起?因為冤枉黎瘟疫去,賺左幾球野,蝕40萬當捐錢。淡友只係睇到炒家撻訂蝕幾十萬,冇睇到人地之前賺既錢已經夠退休。若果淡友既目的係睇人痛苦,好對唔 住,對象唔應該係數緊銀紙既炒家。(我做過agent,職業炒家幾錢入貨幾錢化妝幾錢出貨一年出入幾多我好清楚,信不信由你,炒家呢期係嫌賺唔夠,冇得再 玩)

8. 冇炒家樓市升唔起

炒家炒高樓價呢個誤解唔單只淡友有,甚至連好多業主都有呢個誤解。事實上,炒家係經常創出屋苑呎價新「低」既人,有睇開樓既人都會發現市場 突然會有平10~15%既成交,唔知道呢d就係agent炒家鋤價既成果。地產代理每日既工作之一就係鋤價餵炒家,因為一般玩開既炒家冇即時水位都唔會入 貨,父子都冇情講,好多人以為炒家用市價入貨然後mark高黎賣,大錯特錯。代理日日鋤價,部份分行會獎勵鋤到價既agent,鋤低過市價10%的話,即 使手上冇炒家,同事成交到一樣有10%佣份。因此,係炒家出沒既屋苑入面,經常會有一股睇唔到,但實際存在既樓價下跌壓力。每一個業主(用家)要出貨時, 都會俾agent試探性地鋤一輪摸底,企硬唔俾人鋤既業主可能放盤成個月都冇人睇樓。

另一方面,由於炒家有入就一定有出,令市場長期處於供應充足,樓價上升有壓力。Agent為搏獎金(其實係犯法),專谷炒家貨,正常用家業主要同炒家鬥就只有減價,坦白講用家業主真係多得炒家唔少。

樓價升跌係經濟大圍環境影響,市升,用家盤一樣會升,市跌,炒家一樣有份。炒家只不過係將物業的實際價值在短時間內反映,因為最終接貨都係用家,用家自願付出的價位,就係市場合理價。

冇左炒家會點?好簡單,agent鋤價的動力、動機會消失,因為鋤到好價,都係益左自住用家,自住用家唔會俾獎金,買左又唔賣,倒不如唔鋤價,佣係用買賣價計,唔鋤價做少d反而高d佣,鋤黎做乜?我可以好肯定,業主冇左炒家鋤佢地價,一定放肆心雄。

炒家係市場生態學上,屬於獅子老虎的食肉型,佢地一消失,原本俾佢地食住既鹿、牛、馬等草食型用家業主,就會坐大影響生態。受害既係準買家!

鋤到價買家唔會俾著數agent(俾都唔夠膽收),但做高個價反而可以收多些佣,agent今後既方向好清楚,橫掂以後每單deal都係one night stand,點解唔去盡?

冇買過樓既淡友唔知業主諗乜。同樣,冇做過代理亦唔會知佢地諗乜。分析樓價升跌既人就多,但分析負責做deal既agent,真係只此一家。

9. 長期睇淡最安全

外國諺語有云,一個停止了的時鐘每日都會有兩次報時正確。長期睇淡會令人有一種錯誤的安全感,覺得自己只要堅持,總有一日會正確。我唔想討 論樓價升跌,只係想問一句,係香港冇公屋冇綜援,退休後可以靠租樓度日嗎?就算你有錢交租都唔會租俾你,因為驚你拉柴影響樓價。社會就係咁現實,又老又冇 樓,連仔女都會睇唔起你。大部份人買樓唔係想炒,只係想俾屋企人一個家,以及老年時能夠活得比較有尊嚴,唔駛好似動物咁住係個籠入面。20~30歲個個都 以為自己大把時間大把機會,實際上人生已過了1/3,你唔計劃未來30年,社會就會幫你計劃你既人生。淡下又10年,淡下又10年,人生有幾多個10年俾 你睇淡?

我心知肚明,淡友睇呢篇文睇到最多一半一定睇唔落去,即使佢地睇足全文,都唔會覺得自己有問題,仍然繼續淡落去。但我建議從未買樓的長期淡友可以去SSP的籠屋睇下環境,橫掂第日自己都會搬去住,早d適應下冇壞。當一個人唔介意自己的結局就係好似動物咁,仲有咩野好講?

1. 有利淡消息,業主一定要賤賣

我做過一個有趣實驗,各位可以跟我一齊做。我試下問公司幾個住公屋未買過樓既淡友,而家供樓利息係幾多,可能我既同事都係arm arm赤柱放監出黎,竟然冇人答得出,有一兩個就答3~4厘,最離譜的一個答5厘,但能夠答0.9~1厘既,係一個都冇。

沒有準確的利率訊息,當然會對市況作出錯誤的估計,亦不會知道現時業主的供樓壓力是何其低。我一再強調,市場出現大量劈價盤的原因是大量業主供唔起樓,只 要有能力供,業主會選擇一動不如一靜,因為賣了樓轉租同樣係支出,而且租金遠超實際利息支出,毫不化算。以我住的貧民區屯門市中心為例,月供6000,利 息佔1500,但租金就要1萬,即租金支出=利息支出的6倍左右。劈價賣樓後每月的財政壓力會大4000蚊。因此,自住樓的業主都會選擇繼續月供 6000,其中1500當係交租俾銀行,4500當係儲錢。

窮鬼業主係呢一刻反而冇能力劈價賤賣,唔係唔想劈俾你。

2. 炒家止賺就叫劈價

呢一兩日我有去地產舖問下有冇筍盤,結果係得個桔。唔係話冇業主減價,而係減完都仲比9月份個價貴,點入呀?

報紙仲搞笑,炒家入貨310萬,叫價410萬,新招後減到385萬就叫「劈」,足足叫高75萬,即原價的25%都叫「劈」!情況就好似一個次次考第一既高 材生,測完驗你問佢識唔識,佢話考得好差,你以為今次仲輪唔到你唔合格,點知一派試卷,先知高材生拿99分,99分係佢黎講叫考得好差。

而所謂撻訂其實係新入貨炒家眼見6個月內冇可能升15%以上,在沒有盈利希望的情況下離場止蝕。實際上真正用家在新招後都繼續買樓。

3. 所有業主都可以隨時劈4~5成賣樓

信不信由你,係呢一刻只得有錢佬才有能力劈價3成以上賣樓俾你。原因好簡單,劈價4成我就要抬1成樓價先可以貼錢賣層樓俾你,你欣賞我層樓我貼俾你冇乜所謂,但問題係好似我呢d咁既窮鬼真係冇幾十萬抬俾你。

抬錢賣樓既動機就係,借私人貸款的利息,比供樓利率低,抬完錢反而可以節省利息。但現在暫時供樓利率仲係低,抬錢賣樓冇乜著數,大家可能要等一等。

4. 全港業主PK,我可以獨善其身

很多淡友希望樓價跌,但目的唔係想趁低入貨,而係想睇業主PK,見到有人負資產燒炭食二手飯佢地就會亢奮,說穿了,其實就係心地唔好,損人不利己。

但話時話,如果有一日全港業主都PK,失業冇收入供唔起樓,淡友就可以全身而退做一個食花生既旁觀者?如果係咁天水圍公屋就唔會悲情。訓天橋底既陳伯就係天下最幸福的男人。

事實上,要全港業主一齊PK,香港經濟一定出現嚴重問題,全香港冇人可以冇事甩身。淡友想業主死,但淡友本身自己都要死,仲可能係死先過人。當然,淡友既目的唔係想改善自己生活,由頭到尾都只係想人地同佢一齊PK,所以只要有業主陪佢一齊燒炭佢就覺得賺左。

5. 我冇能力買樓,所以樓價太高

坦白講,我都唔明點解有人會用1萬蚊一呎買樓,但唔明還唔明,有人真係有本事買,首期俾4百萬,月供5萬都供得起,証明人地有本事搵錢多過我,我買唔到1萬蚊樓係我廢,而唔係樓貴。

一再強調,自願的價就係市價,就係合理價,買唔起係人既問題,唔係個價既問題。你唔係身處那個圈子/階層,你不會明白那個圈子階層的人一個月搵幾多,如果你用自己的能力去衡量別人的負擔,一定出錯。

6. 炒家撻訂,我有著數

好多淡友睇報紙見到炒家撻訂,覺得炒家抵死,心都涼晒。但可能佢地未買過樓唔知乜野叫撻訂,撻訂D錢去左邊個度又唔知,總之有人唔見錢就最 開心。事實上樓市係zero sum,有人賺錢就有人接貴貨,有人蝕錢就有人執筍野,d錢唔會唔見左,只係會由傻仔度轉移去叻仔度。炒家撻訂,一方面係炒家蝕錢,另一方面睇,係業主無 啦啦賺左,d錢唔會落入淡友或買家度,係全數落入業主及agent,我唔明白業主多左錢駛淡友點解會開心。現在情況係,一方面冇實力炒家撻訂,另一方面實 力用家、長線投資者創新高呎價,被撻業主錢多左,持貨力增強,個市更加難跌。呢一樣野未買過賣過樓係好難明白。長期淡友一定會誤解。坦白講,如果每次賣樓 買家都撻我訂,一年撻一次我已經可以退休唔駛返工。

另外,我做過agent可以講多一樣野俾大家聽,agent的其中一件工作,就係行家(另一間公司)做到成交後,會話俾業主聽賣平左,然後話俾買家聽買貴 左,撩佢地撻訂,保持客源盤源。更過份係,正常成交係2~3個月後俾佣,撻訂就即時俾,因此agent係有動機撩自己的客、業主撻訂。對於agent黎 講,最理想的環境就係每一單都有人撻訂。

7. 炒家會感到痛苦

任何一個在2009-2010年出入過3次貨既炒家,起碼賺100萬,同一時間持貨50件的大炒家,身家最少5~6億,單係2010年的收 入已經8位數字,呢d人既字典入面,只有幸福,沒有痛苦呢2個字。(美孚大炒家97,03,08乜都經歷過,有咩世面未見過?)點解人地撻40萬都撻得 起?因為冤枉黎瘟疫去,賺左幾球野,蝕40萬當捐錢。淡友只係睇到炒家撻訂蝕幾十萬,冇睇到人地之前賺既錢已經夠退休。若果淡友既目的係睇人痛苦,好對唔 住,對象唔應該係數緊銀紙既炒家。(我做過agent,職業炒家幾錢入貨幾錢化妝幾錢出貨一年出入幾多我好清楚,信不信由你,炒家呢期係嫌賺唔夠,冇得再 玩)

8. 冇炒家樓市升唔起

炒家炒高樓價呢個誤解唔單只淡友有,甚至連好多業主都有呢個誤解。事實上,炒家係經常創出屋苑呎價新「低」既人,有睇開樓既人都會發現市場 突然會有平10~15%既成交,唔知道呢d就係agent炒家鋤價既成果。地產代理每日既工作之一就係鋤價餵炒家,因為一般玩開既炒家冇即時水位都唔會入 貨,父子都冇情講,好多人以為炒家用市價入貨然後mark高黎賣,大錯特錯。代理日日鋤價,部份分行會獎勵鋤到價既agent,鋤低過市價10%的話,即 使手上冇炒家,同事成交到一樣有10%佣份。因此,係炒家出沒既屋苑入面,經常會有一股睇唔到,但實際存在既樓價下跌壓力。每一個業主(用家)要出貨時, 都會俾agent試探性地鋤一輪摸底,企硬唔俾人鋤既業主可能放盤成個月都冇人睇樓。

另一方面,由於炒家有入就一定有出,令市場長期處於供應充足,樓價上升有壓力。Agent為搏獎金(其實係犯法),專谷炒家貨,正常用家業主要同炒家鬥就只有減價,坦白講用家業主真係多得炒家唔少。

樓價升跌係經濟大圍環境影響,市升,用家盤一樣會升,市跌,炒家一樣有份。炒家只不過係將物業的實際價值在短時間內反映,因為最終接貨都係用家,用家自願付出的價位,就係市場合理價。

冇左炒家會點?好簡單,agent鋤價的動力、動機會消失,因為鋤到好價,都係益左自住用家,自住用家唔會俾獎金,買左又唔賣,倒不如唔鋤價,佣係用買賣價計,唔鋤價做少d反而高d佣,鋤黎做乜?我可以好肯定,業主冇左炒家鋤佢地價,一定放肆心雄。

炒家係市場生態學上,屬於獅子老虎的食肉型,佢地一消失,原本俾佢地食住既鹿、牛、馬等草食型用家業主,就會坐大影響生態。受害既係準買家!

鋤到價買家唔會俾著數agent(俾都唔夠膽收),但做高個價反而可以收多些佣,agent今後既方向好清楚,橫掂以後每單deal都係one night stand,點解唔去盡?

冇買過樓既淡友唔知業主諗乜。同樣,冇做過代理亦唔會知佢地諗乜。分析樓價升跌既人就多,但分析負責做deal既agent,真係只此一家。

9. 長期睇淡最安全

外國諺語有云,一個停止了的時鐘每日都會有兩次報時正確。長期睇淡會令人有一種錯誤的安全感,覺得自己只要堅持,總有一日會正確。我唔想討 論樓價升跌,只係想問一句,係香港冇公屋冇綜援,退休後可以靠租樓度日嗎?就算你有錢交租都唔會租俾你,因為驚你拉柴影響樓價。社會就係咁現實,又老又冇 樓,連仔女都會睇唔起你。大部份人買樓唔係想炒,只係想俾屋企人一個家,以及老年時能夠活得比較有尊嚴,唔駛好似動物咁住係個籠入面。20~30歲個個都 以為自己大把時間大把機會,實際上人生已過了1/3,你唔計劃未來30年,社會就會幫你計劃你既人生。淡下又10年,淡下又10年,人生有幾多個10年俾 你睇淡?

我心知肚明,淡友睇呢篇文睇到最多一半一定睇唔落去,即使佢地睇足全文,都唔會覺得自己有問題,仍然繼續淡落去。但我建議從未買樓的長期淡友可以去SSP的籠屋睇下環境,橫掂第日自己都會搬去住,早d適應下冇壞。當一個人唔介意自己的結局就係好似動物咁,仲有咩野好講?

買樓誤解系列(1)

http://finance.discuss.com.hk/viewthread.php?tid=18190192

系列處男作,發表於2010年11月11日,即SSD生效前數天

1. 我可以係跌市買樓一再強調,大跌市時雖然樓價平,但買樓第一炮所需的資金唔會按比例大幅減少。大跌市為何會出現?因為有大量業主賤價割愛。為何賤價都要賣俾 你?因為冇水。冇水點解唔問人借?因為銀行閂水喉。大家必須記住,大跌市的出現,一定配合銀行閂水喉。如果好似而家咁,打2個電話就借10萬,點解要賤賣 層樓俾你?因此,在大跌市時買樓,你必須有心理準備估唔足價,同埋連7成都做唔到。例如200萬跌剩100萬,但銀行只肯估80萬,兼只肯做6成,那麼你 就要嘔52萬。如果你係諗住用10萬經MC上呢個100萬盤,可以返屋企訓覺。

還有,要係大跌市時買平樓,你要有好多現金。我強調係現金,唔係股票或其他需要變賣既資產,因為你既股票係大跌市時一樣會下調。

估價8折做6成,係非常樂觀保守的估計數字,事實上,在08金融海潚時,部份銀行在簽按揭契前突然終止申請,1成會都唔俾上既個案真係發生過。另外,除非閣下係公務員,否則在大跌市時好難保証收入不會下跌。

結論:你需要持有目標樓價50%以上的現金。

2. 樓價一定會下跌

樓價在短期內有上落是事實,但另一個更重要既事實係,以30年為觀察期的話,樓價只會上升不會下跌!03沙士價是香港近十年最低價,美孚的 03呎價約為1600,但1600這個賤價仍然係美孚入伙價的10多倍!事實上,某時期的低價,通常都會比上一個時期的高價還要高。等樓價爆破的朋友,要 有心理準備爆破後的樓價和今日的價其實差不多。

因此,如果你係用家,諗住長住20~30年,只要供款係能力範圍內,就算97年買樓一樣冇問題,因為樓價升跌不會影響你一早已計劃好既供款,20年後樓價一定會超過買入價(請對比1983及2003的樓價)。

結論:以20~30年長線睇,樓價一定升。短期升跌只係為炒家而設。

補充:

有人質疑為何要用過去30年的升幅去推論未來30年,並表示香港的經濟發展已到頂,沒有可能重覆過去30年的升幅。

首先要搞清楚一樣野,就係物價的上 升和經濟的發展不一定有直接的關係,事實上香港今天的經濟規模雖然比1980年時大,但沒有大20倍那麼多(我指實際上,不是數字上)。「物價上升=經濟 發展」背後,最重要的因素是「金錢的產量是按經濟發展的需要而增加」,例如10個人的勞動力產生了10件衫,社會就按這10件衫的價值(假設每件$10) 製造$100的貨幣,分配給付出勞動力的10個人。社會因為有新增的價值(10件新衫)才去製造貨幣,因此「物價上升=經濟發展」。

但現實是殘酷的。自從上世紀70年 代美國單方面脫離金本位後,全球的貨幣逐一跟隨,今時今日世界上所有的貨幣背後均沒有實物支持,純依靠政府的信用進行發行。貨幣脫離了黃金的約束後,製造 貨幣可以和經濟發展完全脫勾,經濟好時固然可以加印貨幣,經濟差時更加要印。全世界現時在「沒有新增價值」的情況下,卻可以以火箭升空的速度加印貨幣,結 果是經濟沒有大幅發展,物價卻大幅上升。製造貨幣的特權階級成為社會的大贏家,製造實物的勞動者卻被社會嚴懲,扭曲了世人的價值觀。衡量一個人的價值,不 是看這個人能為社會作多大的貢獻,而是看這個人能夠從社會奪取的資源有多少。

貨幣脫離金本位30多年,因此過去30年的樓價走勢絕對有參考價值。坦白說,今後貨幣的貶值速度能保持30年只跌95%,已經是非常幸運。

3. 遲早會加息

講得呢句說話,即係話而家息平。係人都知遲早會加息,但重點係息口仲平既時候你還左幾多本金?房貸好公道,本金少左,息會按比例減少,係低息環境下你可以好輕易就還幾十萬本金。即使加息,對你的實際影響極微。

結論:趁息平多還本金,點會怕加息!

4. 供30年樓係樓奴

我寫包單,講得出呢句說話既人學歷不會超過小學6年級。世界上所有銀紙現在均以每30年跌95%的速度貶值,簡單來說,30年後港幣的購買 力,和現在的日圓差不多,即是說,今日我借港幣100萬,還到第30年就變左100萬yen。當然,中途你係有不斷供款,但你每期供款的購買力都會貶值, 變相你可以用貶值後的貨幣購買未貶值的資產。幻想一下你可以用今日既身家,坐時光機回到1980年買當時既樓。因此,30年的供款期內,供款壓力係會越來 越低,因為你的債項不斷貶值。頭10年是最艱苦困難的,中間10年可以有閒錢去下旅行,後10年供款比飲茶錢還要低。

結論:供樓係會越來越輕鬆

5. 唔買樓可以租

供樓壓力會隨時間減弱,因為你用未來貶值後的錢,去還今日未貶值的錢。但租金就相反,你一定要用當時的錢去還當時的錢,即是說,當供款金額 固定下來,租金卻係會隨時間不斷上升,例如貨幣每30年下跌95%,租金就會同樣以每30年升20倍的速度上升。當然,這是假設沒有加息。但即使有加息, 亦不見得租樓會有著數,因為業主會按成本加租,冇死錯人。

租樓的另一個問題係,你和業主的財富差距越拉越大,假設今天你和業主身家都係100萬,租了2年樓洗左20萬,你的身家變成80萬,業主就120萬,差距 係40萬,亦即你現有身家的一半。當然,你投資有道,可以用呢80萬本金賺超過40萬,則另作別論。但假如你唔投資,純做租客,你會白白將日後入市上車既 資金送俾業主。租金回報5厘知唔知即係點解?即係話你租20年的話,你就送左層樓俾業主。多謝夾承惠。

結論:年輕人應該同阿媽住,省回租金支出。要2人世界可以租時鐘。

6. 生活質素唔可以妥協

好多人唔接受舊樓、單幢樓、大西北,話唔會為上車而降低生活質素。請讓本人告訴你一個殘酷的事實,如果你的能力只能買舊樓、單幢樓、大西 北,你冇資格講質素。如果你係打工仔,每日可以係屋企既清醒時間唔會超過6小時,有乜質唔質素?訓到朝早11點,然後先考慮今日返唔返公司打點一下,呢d 就叫質素。

結論:先講資格,後談質素

7. 炒家炒高樓價

錯!實際係「買家買高樓價」。冇炒家唔代表用家會平賣俾你,有人肯接炒家貨,代表炒家有眼光,估計到未來樓價有水位,係先有購買力後有炒 家。其實有買過樓都會知,買炒家貨好買過用家貨,議價空間比用家盤大,因為炒家係做生意,計好個ROI唔怕平少少賣俾你,但用家就皇帝女唔憂嫁,大不了住 多2年先賣。再者,炒家買完一定賣,穩定供應,用家就有入冇出,炒家有時反而會有調低樓價的平衡功能。

結論:自願的價就係市價

8. 市區樓抗跌力強

抗跌力是大跌市時業主繼續供款的能力,因此,以下類別的物業抗跌力一定強:

一、 大部份業主已供斷的屋苑(沒有供樓壓力)

二、 大部份業主的買入價都很低(供樓壓力極低)

三、 業主真係好有錢(沒有收入壓力)

因此,老牌屋苑(第1類)、新界100萬上下的物業、半山豪宅的抗跌力一定高,其中半山豪宅最強。而老牌屋苑如太古城、美孚新村都位於市區,故產生抗跌力強的假象。

以下物業抗跌力最弱:

一、 被發展商食盡溢價的一手樓

二、 業主多數是高收入打工仔(一旦失業很難在短時間內找到同樣人工的工作)

三、 入伙日期接近爆破日期的物業

此三項條件可以同時出現。

9. 以外幣代替房地產作為儲蓄保值工具

QE配合部份準備金制度,令美元的流通量大幅增加,其他貨幣相對美元因此出現顯著升值。身邊有不少朋友考慮將港元兌換成人民幣或澳元搏升值。

首先,我不反對將手頭持有的少量現金換成外幣對沖港幣貶值。但若果手頭持有數十萬至數百萬港幣,樓與外幣2擇其一,則一定是選擇磚頭實物。

QE是聯儲局在帳簿上無中生有數以千萬億計的美元,其好處有四:

1. 刺激美國本土消費市場,改善失業,這個是官方解釋

2. 用貶值後的美元償還美國國債,借10蚊還7蚊,淨賺3蚊

3. 削弱以美元作儲備的國家之國力,尤其是與美國有大額貿易順差的國家,如中國

4. 增強本國出口的競爭力,尤其農產品

顯而易見,美國以外的國家為保出口貿易與及國家的整体經濟,必須參與印銀紙遊戲令本國貨幣貶值。澳元、人民幣和美元一樣正在不斷印銀紙,盡可能維持現有的 美元匯率,由於澳元、人民幣不斷增加貨幣流通量,令本土物價上漲,坊間因而指控美國「輸出通脹」。澳元、人民幣及其他貨幣正在不斷印銀紙,不斷貶值是鐵一 般的事實,香港人之所以會產生澳元升、人民幣升值的感覺,是因為美元港元的貶值速度更快。任何一個中國、澳洲的老百姓,在這一刻都會感到自己的貨幣在本國 內的購買力越來越低,通脹猛於虎!

澳元、人民幣等貨幣雖然在近期相對港幣有顯著大額升幅,但相對實物例如物業甚至日用品,澳元和人民幣同樣是不斷貶值。將身家投放在澳元和人民幣,只不過是 由一條賊船跳去另一條,到最後即使外幣有所斬獲,對實物的購買力無可避免一定會下跌,因為貨幣的供應增加速度遠超實物的生產速度。因此,我是極其反對賣樓 買外幣的投資方法。但我要強調一點,人在社會生存一定要有一點現金,購買貶值速度較低的外幣作對沖我是贊成的。我所反對的是以外幣作為主要投資/儲蓄工 具。

香港使用人民幣作為儲蓄工具還有一個嚴重問題,就是日限提款2萬元的限制。即使你在滙豐、恆生、渣打、中銀、東亞……等10間銀行各開一個人民幣戶口,提款或轉移100萬仍需時5個工作天。顯而易見,對香港人來說,以人民幣作為大額儲蓄貨幣現時仍然是不可行的。

10. 中國富豪的資金會徹離香港

要分析中國富豪為何在香港買樓買股,就一定要明白中國的國情。在中國要發財,一定要有人脈關係,所謂「關係」,說穿了其實是利益輸送,行賄 送禮送女人。這些行為雖然是中國商界的基本功,但名義上其實是犯法的。在中國要發財而又出於污泥而不染,基本上是沒有可能,所有人都有犯法,甚至應說所有 人都必須犯法。中國的富豪心知肚明中國是人治不是法治,都會怕有朝一日自己會變成第二個黃光裕或周正毅,突然有一天被人上門抄家,家財盡失,瑯璫入獄。財 產只要仍在中國國內,都會有被完全充公的可能,為保獲家產,富豪必須將生意運作以外的錢偷運到境外(走資也是非法的),日後即是不幸在中國被抄家,仍然可 以有資金行賄購買自由。否則一旦成為一無所有的階下囚,則一定永不超生。

因此,中國的富豪千山萬水把以千萬計的現金偷運到香港買樓買股,你要他把錢送回中國即是要他的命。香港是中國富豪的保險箱,只要香港的法制仍健全,行政司法仍獨立於中國大陸,中國富豪的資金是不會離開香港的。(國內同胞如欲轉載,請自行和諧)

補充:來香港買樓的大陸人,不限於億萬富豪。根據我所認識的國內朋友的親身經驗 (100%真實冇吹水,我甚至有陪同睇樓),一些身家數百萬的小康之家,為求孩子能有香港身份證,又或者想追仔避開城管打胎,都會在大西北、北區購買低價 物業作「生仔屋」給老婆養胎。這些生仔屋在完成任務後都會留在香港放租,不會變賣徹資,因為國內同胞不分貧富,都相信香港的法治精神能夠保障他們的財產擁 有權。很多一日投訴到黑的香港人其實生在福中不知福。

後記:市場會嚴懲睇錯市既人,若果你覺得我的觀點係錯的話,就讓市場去懲罰我,同樣,閣下若果睇錯市,必須要有被市場嚴懲的心理準備。補充一點,沒有自住樓的租客,你們現時正在被市場懲罰,反不反省是你們的自由。

Sunday, June 3, 2012

GLD – The Central Bank Of The Bullion Banks

The black curve (left scale) of the following chart shows the London

pm gold fixing in U.S. dollars from 1 January 2006 to 30 April 2012.

During the light-blue intervals which span about 35% of the entire

period, the gold price increased at an annualized rate of 41.1%. During

the remaining intervals, the price increased only at an annualized rate

of 7.9%. The light-blue intervals are the result of a trading algorithm

whose buy signals are indicated by the green dots and whose sell signals

by the red dots.

In this article, we explain how the signals can be computed from the variations of the inventory of the SPDR Gold Shares exchange traded trust (NYSEArca:GLD). We explain why the inventory adjustments can hardly be caused by price arbitrage between the GLD share price and the loco London spot price alone. We rather claim that bullion banks finance their inventory by lending it or selling it to GLD investors and that bullion banks manage their physical reserves by accessing the physical gold inside GLD.

The fact that a certain type of inventory adjustments has predictive power, supports the idea that large inventory changes are the result of active reserve management. This provides us with a unique window into the flow of physical gold that is usually obscured by the dominance of paper gold trading. A similar, but somewhat less robust result is shown for the iShares Silver Trust (NYSEArca:SLV).

The idea of a trading strategy based on changes to the GLD inventory goes back to Lance Lewis’ GLD Puke Indicator. The term Central Bank Of the Bullion Banks was coined by FOFOA who wrote about the GLD Puke Indicator in Who Is Draining GLD. In that article, FOFOA expands on Randal Strauss’ idea that GLD redemptions indicate a preference for physical gold over paper gold (see his Gold Dips Towards $1360/oz … and Gold Nears 3-Months Low…).

GLD is managed differently. As of 29 May 2012, there exist about 421 million shares of the trust. Each share corresponds to roughly 0.097 ounces of gold. The trust therefore contains 40.84 million ounces of gold (1270 tonnes) that are worth $64.5bn at the London pm fixing price of $1579.50 per ounce.

The number of shares of the trust can be changed only in multiples of a basket (100000 shares) and only by the so-called Authorized Participants (APs). According to the prospectus of 26 April 2012, these are Barclays, Citigroup, Credit Suisse, Deutsche Bank, Goldman Sachs, HSBC, J.P. Morgan, Merrill Lynch, Morgan Stanley, Newedge, RBC, Scotia, UBS and Virtu Financial. Each of these APs can

We see that the changes to the inventory are not exactly normally

distributed. In addition to a skew towards small redemptions and larger

creations, there are obvious fat tails

on both sides. In the following, we are interested in these fat tails,

i.e. in the excess number of large creations and large redemptions.

We see that the changes to the inventory are not exactly normally

distributed. In addition to a skew towards small redemptions and larger

creations, there are obvious fat tails

on both sides. In the following, we are interested in these fat tails,

i.e. in the excess number of large creations and large redemptions.

On the first day (1 January 2006), our strategy is not invested. At about 4.50pm New York time on every New York trading day, i.e. after the close, the current inventory of GLD is published. If the strategy is not invested and the inventory has decreased by 250000 ounces or more compared with the previous trading day, our strategy buys gold at the London pm fixing price on the following day. If the strategy is invested and on any New York trading day, the inventory has increased by 250000 ounces or more, our strategy sells the gold at the London pm fixing price on the following day. These buy and sell signals are indicated by the green and red dots in the chart at the beginning of this article. The blue curve (right scale) shows the total inventory of GLD in millions of ounces.

Recall that the original GLD Puke Indicator by Lance Lewis counts a decrease of the inventory by 1% or more as a buy signal. We prefer an absolute threshold (250000 ounces) rather than a relative one. This yields a more consistent performance of the strategy over the entire period from 2006 to 2012 and is also more plausible in view of our interpretation of the inventory changes as reserve management (details below). Note that GLD began trading on 18 November 2004, and we have omitted the first 13.5 months from the analysis.

Of course, nobody would actually trade according to this strategy, simply because even during the times at which the strategy is not invested, the gold price still increases at an annualized rate of 7.9%. The strategy merely serves to demonstrate that inventory changes do have some power of predicting the future gold price.

Assume you know from the data sheet that one share of GLD corresponds to 0.097 ounces of gold and that the London spot price is $1579.50 per ounce. This yields a Net Asset Value (NAV) of $153.21 per share. Even if you do not know the price at which GLD is currently trading, you nevertheless know that one share of GLD is worth $153.21. So if you bid $153.21 per share (plus spread), you should be able to purchase your shares of GLD, simply because GLD contains physical gold loco London that you could equally well purchase directly for the spot price (plus spread).

If you bid less than $153.21, you cannot expect to receive any shares, simply because the seller would be foolish to sell at this price. If you bid more than $153.21, you would effectively hand a free lunch to the seller. In fact, if you did, your counterparty can indeed capture this free lunch by arbitrage.

If for some reason, GLD trades at a discount to its NAV, the arbitrageur can go long GLD and short paper gold. Most likely, GLD will sometimes trade at a small premium to NAV and at other times at a small discount, and so the arbitrageur can easily unwind the paper gold arbitrage after a short period of time.

Let us stress that paper gold arbitrage should be largely unnecessary though, simply because every investor knows that the NAV is the price at which GLD ought to trade. Deviating from this price would be foolish, and so in most cases the threat of arbitrage ought to be sufficient in order to keep the market efficient while the actual arbitrage would not be necessary.

In the unlikely event that there is so much buying pressure that GLD consistently trades at a premium even though paper gold arbitrage is performed, the short GLD and long unallocated gold positions of the arbitrageur would keep growing. How can this be avoided?

Due to the transaction costs, the APs will avoid the creation-redemption arbitrage as far as possible and perform it only if their paper gold arbitrage position gets way out of balance. Let us finally recall that every market participant knows the NAV and the spot price and therefore the fair price of a GLD share, and so even paper arbitrage should normally be unnecessary.

Then why do we see so many inventory adjustments? Is there a second reason for adjusting the inventory beyond the obvious price arbitrage?

Some investor decides to buy a certain number of GLD shares, but he is not interested in other gold investments. If he is willing to pay a premium for these GLD shares if necessary, he will definitely get the desired number of shares. The price to pay is that an AP who acts as the arbitrageur, can pocket that premium as a profit for the service of creating the desired number of shares.

There is, however, a second point of view on the creation and redemption that is not centred around the GLD investor, but rather around the AP. Let us assume the AP decides to put a certain amount of gold into GLD. He therefore transfers the gold to the trustee, receives GLD shares in turn and sells these shares into the market. If GLD shares trade at a discount as the consequence, the rest of the market can act as the arbitrageur and, for example, slightly favour GLD over other gold investments, and thereby absorb all the newly created GLD shares.

So which one is it? Do the investors in GLD request a certain number of shares, and the AP delivers by performing the arbitrage and creating the shares? Or does the AP decide to place a certain amount of gold into GLD, and then the market absorbs these additional shares?

We suspect that at least those inventory adjustments that constitute the fat tails of the distribution, i.e. beyond the threshold of 250000 ounces per day, are in effect initiated by the AP rather than by the GLD investors.

If it were just the arbitrage in response to the investors, why would the trading strategy work? The only explanation would be that GLD investors represent the ‘dumb money’ (or ‘weak hands’) whereas all other gold investments represent the ‘smart money’ (‘strong hands’). In this scenario, GLD would lose a significant amount of inventory when the dumb money sells while the smart money buys, triggering a buy signal. Conversely, when the smart money sells and the dumb money buys, GLD would gain inventory which constitutes a sell signal.

The problem with this view is, however, that there is no reason to assume that GLD is held primarily by the weak hands whereas the other gold investments that are all tied to the London spot price, represent the strong hands. Both GLD and unallocated gold OTC or COMEX futures are held by sophisticated investors, endowment funds or hedge funds. Although many retail investors, i.e. typically weak hands, are in GLD, the same is true for other gold investments such as coins and retail bars, COMEX futures, and bank sponsored gold-related products that, in aggregate, all appear on the other side of the arbitrage, i.e. in the spot market outside of GLD.

The only consistent interpretation would be the following: The fact that the suggested trading strategy works, confirms that in aggregate GLD is dominated by weak hands whereas in aggregate all other gold investments are dominated by strong hands. This point of view is not plausible at all.

We therefore suspect that those inventory adjustments that are relevant to our trading strategy, i.e. those beyond 250000 ounces per day that form the fat tails, are rather initiated by the APs.

In order to reduce the capital requirement, our company has several options, for example,

Even better, should the portion of the inventory corresponding to this flow decrease unexpectedly, they can even purchase a basket of GLD shares in the market, redeem them and recover the gold at any time. In this sense, GLD is even superior to the Kitco pooled account. Kitco can decrease their inventory only if some of the investors in their pooled account decide to sell. GLD offers the advantage that there is a liquid market for GLD shares from which the bullion bank can purchase additional shares at any time. The average daily trading volume of GLD is about 12 million shares which represents an inventory of 1.16 million ounces or 36.2 tonnes.

The bullion bank can hold gold instruments in various forms, for example,

Besides the credit risk, i.e. the risk that a counterparty fails to honour its obligations, any bullion bank that holds only a fractional reserve against their customers’ deposits, is exposed to liquidity risk. For example, customers might request allocation of their unallocated account balances. In this case, both a liability of the bank (the customers’ unallocated account balance) and an asset (a reserve of physical gold) disappear from the balance sheet. This is analogous to a customer withdrawing dollars in cash from a commercial bank or to a customer transferring out credit money from her account.

Since such a withdrawal involves a reduction of our bullion bank’s reserves, our reserve ratio deteriorates. We now have less reserves relative to the size of our balance sheet. This is where GLD comes in handy. We can easily replenish our reserves by

Let us try to disentangle these steps. The bullion banks presumably hold a part of their reserve in the form of physical gold in their own vault and another part in the form of GLD shares. Whenever they acquire a larger amount of additional physical reserves, they probably place some of it into GLD and create new baskets of shares, but they do not necessarily sell these GLD shares to investors and even if they do, this need not happen at the same point in time.

Conversely, if a bullion bank faces a large allocation request and needs to replenish the physical gold in their vault, they can redeem baskets of GLD that they already own. In a true emergency in which a bullion bank runs out of reserves, they can even

Since our trading strategy uses only the instances in which shares of GLD are redeemed for physical gold, it is sensitive to the following two situations:

One of the largest recent reductions in GLD inventory occurred on 22 May 2012 with a net redemption of 563024 ounces, i.e. 58 baskets or about 17.5 tonnes. This event coincides up to one week with a negative one-month GOFO quoted by J.P. Morgan on 16 May 2012 as reported by Izabella Kaminska. This indicates that J.P. Morgan was presumably willing to pay a premium in order to swap dollars for gold, i.e. they were willing to buy at spot and sell a one-month forward at a discount.

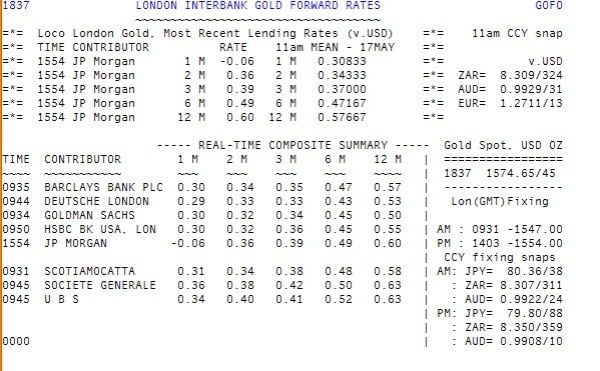

Robert LeRoy Parker spotted another example. Some of the largest reductions in GLD inventory occurred on 23 and 24 August 2011 with redemptions of 798417 ounces and 876288 ounces, together 172 baskets or about 52 tonnes of gold. This coincides with the following reported Gold Forward Offered Rates (GOFO) found on the LBMA website at that time. The numbers are GOFO for 1,2,3,6 and 12 months:

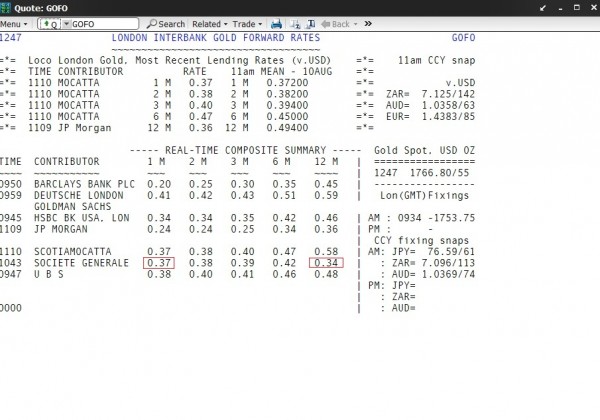

A third example was again reported by Izabella Kaminska. On 10 August 2011, Société Générale quoted an inverted term structure:

Again, this coincides with losses of GLD inventory of 418373 ounces on 9 August 2011, 759559 ounces on 11 August 2011 and 408988 ounces on 12 August 2011, together 1.59 million ounces, 164 baskets or 49.3 tonnes. Since Société Générale is not an AP, apparently someone else took the gold out of GLD and lent it to them.

We have to concede that the published GLD inventory only records the aggregate daily changes. The fax from HSBC that Warren James at Screwtape Files discovered, shows redemptions of 759618 ounces for 16 August 2011. This must have been some intra-day movement that was compensated by even larger creations on the same day because the reported aggregate change of inventory for that day is positive. Apparently the inventory changes are such a good indicator that the trading strategy is still effective even if we work with daily aggregates only.

FOFOA must have had this picture in mind when he called GLD the Central Bank of the Bullion Banks, i.e. a depository of additional reserves shared by those bullion banks that are at the same time APs.

It remains to understand why the paper price of gold rises during the period immediately following strong demand for physical gold.

Notice that the buyer(s) purchase only about 5 to 50 tonnes of physical gold on the relevant days whereas about 2700 tonnes of paper gold are sold every trading day (total transaction volume of all sales, assuming 62.5 trading days per quarter) according to the Loco London Liquidity Survey published in August 2011. Although the physical purchase is tiny compared to the trading volume of paper gold, after this purchase the price of paper gold increases.

We might attribute this to the excellent timing of the large physical buyer whose activity we can sometimes spot by watching the inventory of GLD.

What if somebody manages the price of paper gold in such a way as to control the flow of physical gold? The following chart shows the remarkably uniform increase in the dollar price of gold over the previous decade from 2002 to 2011. The black line is the regression line in the logarithmic diagram. It starts on 2 January 2002 at $266.60 and ends on 29 December 2011 at $1589.95 for an annual rate of increase of 19.56%. The blue and light blue bands are a factor of 1.118 and 1.25 away from the black line.

Does this chart look ‘managed’? Maybe…

How would one manage the price in such a way as to control the flow of physical gold? Let us make up some numbers in order to arrive at a toy model. There is a flow of new gold into the market from mining and recycling. This amounts to about 3000 tonnes per year. If a third of this amount goes through the London market, this amounts to about 4 tonnes per trading day (assuming 250 trading days per year).

In addition, there are some investors who sell allocated gold and some who purchase allocated gold. Let us be generous and assume that this trading volume of allocated gold is three times as big as the flow of new gold. This suggests a trading volume of 16 tonnes of physical gold per trading day in the London market which is tiny compared to the trading volume of paper gold (2700 tonnes per trading day). It is important to keep in mind that the inflow of new gold has an approximately constant weight per day.

It firstly seems plausible that allocation requests of about 5 to 50 tonnes are big enough in order to affect the reserve management of the bullion banks and thereby result in changes to the GLD inventory. It is also plausible that the management of the physical reserve that underlies the gold market is a rather delicate business because the paper trading volume is so huge compared to the physical volume.

Secondly, let us assume that the allocation requests by the buyers of physical gold involve an approximately constant sum of dollars per time. Investors or central banks who gradually switch from dollars into gold or who gradually diversify their foreign exchange reserves. We therefore have an inflow of physical gold that is steady in terms of weight per time, but an outflow that is steady in terms of dollars per time.

In order to manage the flow of physical gold, someone might therefore try to manage the dollar price of paper gold. Since the physical inflow is by weight, but the outflow by dollars, one might try to increase the paper price in response to an increased outflow of physical gold and try to lower the paper price whenever there are plenty of reserves. There you go. This is indeed consistent with what we see in our trading strategy: The price of paper gold increases in response to an outflow of physical gold.

Let us keep this speculation in mind as a second possible explanation of why the trading strategy works.

In light of this interpretation, it would be worthwhile watching the total inventory of GLD (the blue curve, right scale, in the very first diagram of this article). The inventory of GLD, the central bank of the bullion banks, should move in line with their total physical reserves. We see that the inventory peaked at 42.1 million ounces (1310 tonnes) in summer 2010, a level that has not been reached ever since. Even though the dollar price of gold rose further from $1200/ounce to $1900/ounce, the investors in GLD were not able to entice the APs to make additional inventory available.

Nevertheless, the present GLD inventory of still 40.84 million ounces (1270 tonnes) forms a considerable reserve of physical gold which the bullion banks can draw on in order to replenish their own reserves. Should the total inventory continue to decline, this would indicate increasing pressure on the physical reserves of the bullion banks. The financial media, however, would presumably tell you that investors are no longer interested in gold, that they sold their shares in GLD and that this was bearish for gold. Nothing would be further from the truth.

The following histogram shows the distribution of the daily changes to the inventory of SLV.

The threshold for our trading strategy is an inventory change by at

least 3.5 million ounces (about 108.9 tonnes worth $98.9 million). Apart

from the choice of this threshold, the trading strategy is identical.

The threshold for our trading strategy is an inventory change by at

least 3.5 million ounces (about 108.9 tonnes worth $98.9 million). Apart

from the choice of this threshold, the trading strategy is identical.

The following chart finally shows the performance of this strategy. The black curve (left scale) is the London Silver Fixing in U.S. Dollars. Again, buy and sell signals are indicated by green and red dots, respectively, and the light-blue shaded areas are the times during which the strategy is invested, i.e. about 25% of the time. During the invested periods, the silver price increases at an annualized rate of 28.7% whereas during the remaining times it increases only at an annualized rate of 11.6%. The blue curve (right scale) finally shows the total inventory of SLV.

Whereas in the case of GLD, basically any threshold beyond our 250000 ounces works, as long as it gives a sufficient number of signals at all, it is substantially more difficult to find efficient parameters for the strategy involving SLV and silver. Nevertheless, we do have an effective trading strategy, and so everything said about reserve management and GLD seems to apply to silver and SLV, too.

http://victorthecleaner.wordpress.com/2012/06/01/gld-the-central-bank-of-the-bullion-banks/

In this article, we explain how the signals can be computed from the variations of the inventory of the SPDR Gold Shares exchange traded trust (NYSEArca:GLD). We explain why the inventory adjustments can hardly be caused by price arbitrage between the GLD share price and the loco London spot price alone. We rather claim that bullion banks finance their inventory by lending it or selling it to GLD investors and that bullion banks manage their physical reserves by accessing the physical gold inside GLD.

The fact that a certain type of inventory adjustments has predictive power, supports the idea that large inventory changes are the result of active reserve management. This provides us with a unique window into the flow of physical gold that is usually obscured by the dominance of paper gold trading. A similar, but somewhat less robust result is shown for the iShares Silver Trust (NYSEArca:SLV).

The idea of a trading strategy based on changes to the GLD inventory goes back to Lance Lewis’ GLD Puke Indicator. The term Central Bank Of the Bullion Banks was coined by FOFOA who wrote about the GLD Puke Indicator in Who Is Draining GLD. In that article, FOFOA expands on Randal Strauss’ idea that GLD redemptions indicate a preference for physical gold over paper gold (see his Gold Dips Towards $1360/oz … and Gold Nears 3-Months Low…).

Creation and Redemption of GLD Baskets

The method by which GLD grows or shrinks differs radically from the way in which conventional investment funds operate. If you want to invest in such a fund, you wire money to the manager. If you wish to withdraw money, you fax them a withdrawal notice. Depending on the contributions and withdrawals, the manager then either invests the contributed cash or sells investments in order to satisfy the requests for withdrawal.GLD is managed differently. As of 29 May 2012, there exist about 421 million shares of the trust. Each share corresponds to roughly 0.097 ounces of gold. The trust therefore contains 40.84 million ounces of gold (1270 tonnes) that are worth $64.5bn at the London pm fixing price of $1579.50 per ounce.

The number of shares of the trust can be changed only in multiples of a basket (100000 shares) and only by the so-called Authorized Participants (APs). According to the prospectus of 26 April 2012, these are Barclays, Citigroup, Credit Suisse, Deutsche Bank, Goldman Sachs, HSBC, J.P. Morgan, Merrill Lynch, Morgan Stanley, Newedge, RBC, Scotia, UBS and Virtu Financial. Each of these APs can

- Transfer the physical gold that corresponds to a basket of shares to the trustee. The trustee then creates a basket of new shares and transfers them to the AP in return (creation)

- Transfer a basket of shares to the trustee and receive the corresponding physical gold in return. The trustee then cancels the shares (redemption).

Creation and Redemption Statistics

Before we consider why an AP might wish to create or redeem baskets, let us take a look at the statistics of these creations and redemptions. The following histogram shows the frequency of the daily inventory changes depending on their size in millions of ounces (creations are counted positive, redemptions negative). Days on which the inventory remained constant, are ignored. We have analyzed the period from 1 January 2006 to 30 April 2012. Recall that one basket consists of 100000 shares which presently represents 9700 ounces or 301.67kg of gold, worth about $15.3 million.

Distribution of daily GLD inventory changes in millions of ounces from 1 January 2006 to 30 April 2012

The Trading Strategy in Detail

For GLD, we are interested in creations and redemptions that exceed the threshold of 250000 ounces on a single day, i.e. about 25 baskets or 7.78 tonnes (presently worth $394 million). Note that this threshold essentially captures the fat tails of the distribution of inventory changes displayed above.On the first day (1 January 2006), our strategy is not invested. At about 4.50pm New York time on every New York trading day, i.e. after the close, the current inventory of GLD is published. If the strategy is not invested and the inventory has decreased by 250000 ounces or more compared with the previous trading day, our strategy buys gold at the London pm fixing price on the following day. If the strategy is invested and on any New York trading day, the inventory has increased by 250000 ounces or more, our strategy sells the gold at the London pm fixing price on the following day. These buy and sell signals are indicated by the green and red dots in the chart at the beginning of this article. The blue curve (right scale) shows the total inventory of GLD in millions of ounces.

Recall that the original GLD Puke Indicator by Lance Lewis counts a decrease of the inventory by 1% or more as a buy signal. We prefer an absolute threshold (250000 ounces) rather than a relative one. This yields a more consistent performance of the strategy over the entire period from 2006 to 2012 and is also more plausible in view of our interpretation of the inventory changes as reserve management (details below). Note that GLD began trading on 18 November 2004, and we have omitted the first 13.5 months from the analysis.

Of course, nobody would actually trade according to this strategy, simply because even during the times at which the strategy is not invested, the gold price still increases at an annualized rate of 7.9%. The strategy merely serves to demonstrate that inventory changes do have some power of predicting the future gold price.

Price Arbitrage

Let us now consider why an Authorized Participant (AP) might wish to create or redeem baskets of GLD. We therefore need to understand how GLD is priced and which type of arbitrage might enforce this price.Assume you know from the data sheet that one share of GLD corresponds to 0.097 ounces of gold and that the London spot price is $1579.50 per ounce. This yields a Net Asset Value (NAV) of $153.21 per share. Even if you do not know the price at which GLD is currently trading, you nevertheless know that one share of GLD is worth $153.21. So if you bid $153.21 per share (plus spread), you should be able to purchase your shares of GLD, simply because GLD contains physical gold loco London that you could equally well purchase directly for the spot price (plus spread).

If you bid less than $153.21, you cannot expect to receive any shares, simply because the seller would be foolish to sell at this price. If you bid more than $153.21, you would effectively hand a free lunch to the seller. In fact, if you did, your counterparty can indeed capture this free lunch by arbitrage.

Paper Gold Arbitrage

Suppose there is a buyer of GLD shares who acts foolishly and who drives up the price of GLD shares well beyond their NAV. Any arbitrageur can now go short GLD and long any other gold investment that follows the London spot price. This allows him to capture the arbitrage, i.e. to lock in a risk-free profit. This works because GLD will eventually trade at its NAV again, and the arbitrageur can unwind both positions at that point in time. We call this form of arbitrage paper gold arbitrage because the arbitrageur can go long unallocated gold in addition to short GLD while the physical gold inside GLD is not touched.If for some reason, GLD trades at a discount to its NAV, the arbitrageur can go long GLD and short paper gold. Most likely, GLD will sometimes trade at a small premium to NAV and at other times at a small discount, and so the arbitrageur can easily unwind the paper gold arbitrage after a short period of time.

Let us stress that paper gold arbitrage should be largely unnecessary though, simply because every investor knows that the NAV is the price at which GLD ought to trade. Deviating from this price would be foolish, and so in most cases the threat of arbitrage ought to be sufficient in order to keep the market efficient while the actual arbitrage would not be necessary.

In the unlikely event that there is so much buying pressure that GLD consistently trades at a premium even though paper gold arbitrage is performed, the short GLD and long unallocated gold positions of the arbitrageur would keep growing. How can this be avoided?

Creation-Redemption Arbitrage

The answer is that if an AP performs such an arbitrage and his position of short GLD versus long unallocated gold has grown beyond the size of a basket, he can unwind the position at any time by having a basket created, i.e. he- has a basket worth of his unallocated gold allocated,

- transfers the gold to the trustee,

- receives a basket of created shares,

- uses these shares in order to close his short position in GLD.

- transfers a basket of shares to the trustee for redemption,

- receives a basket worth of allocated gold,

- uses this gold in order to close his short unallocated position.

Due to the transaction costs, the APs will avoid the creation-redemption arbitrage as far as possible and perform it only if their paper gold arbitrage position gets way out of balance. Let us finally recall that every market participant knows the NAV and the spot price and therefore the fair price of a GLD share, and so even paper arbitrage should normally be unnecessary.

Then why do we see so many inventory adjustments? Is there a second reason for adjusting the inventory beyond the obvious price arbitrage?

Two Different Views on Inventory Changes

How can we better understand the creation and redemption of baskets? The arbitrage point of view was the following:Some investor decides to buy a certain number of GLD shares, but he is not interested in other gold investments. If he is willing to pay a premium for these GLD shares if necessary, he will definitely get the desired number of shares. The price to pay is that an AP who acts as the arbitrageur, can pocket that premium as a profit for the service of creating the desired number of shares.

There is, however, a second point of view on the creation and redemption that is not centred around the GLD investor, but rather around the AP. Let us assume the AP decides to put a certain amount of gold into GLD. He therefore transfers the gold to the trustee, receives GLD shares in turn and sells these shares into the market. If GLD shares trade at a discount as the consequence, the rest of the market can act as the arbitrageur and, for example, slightly favour GLD over other gold investments, and thereby absorb all the newly created GLD shares.

So which one is it? Do the investors in GLD request a certain number of shares, and the AP delivers by performing the arbitrage and creating the shares? Or does the AP decide to place a certain amount of gold into GLD, and then the market absorbs these additional shares?

We suspect that at least those inventory adjustments that constitute the fat tails of the distribution, i.e. beyond the threshold of 250000 ounces per day, are in effect initiated by the AP rather than by the GLD investors.

If it were just the arbitrage in response to the investors, why would the trading strategy work? The only explanation would be that GLD investors represent the ‘dumb money’ (or ‘weak hands’) whereas all other gold investments represent the ‘smart money’ (‘strong hands’). In this scenario, GLD would lose a significant amount of inventory when the dumb money sells while the smart money buys, triggering a buy signal. Conversely, when the smart money sells and the dumb money buys, GLD would gain inventory which constitutes a sell signal.

The problem with this view is, however, that there is no reason to assume that GLD is held primarily by the weak hands whereas the other gold investments that are all tied to the London spot price, represent the strong hands. Both GLD and unallocated gold OTC or COMEX futures are held by sophisticated investors, endowment funds or hedge funds. Although many retail investors, i.e. typically weak hands, are in GLD, the same is true for other gold investments such as coins and retail bars, COMEX futures, and bank sponsored gold-related products that, in aggregate, all appear on the other side of the arbitrage, i.e. in the spot market outside of GLD.

The only consistent interpretation would be the following: The fact that the suggested trading strategy works, confirms that in aggregate GLD is dominated by weak hands whereas in aggregate all other gold investments are dominated by strong hands. This point of view is not plausible at all.

We therefore suspect that those inventory adjustments that are relevant to our trading strategy, i.e. those beyond 250000 ounces per day that form the fat tails, are rather initiated by the APs.

Inventory Financing and Reserve Management

Why would an AP decide to increase or decrease the inventory of GLD other than in order to capture some arbitrage profit? There are two plausible scenarios. In order to understand them, let us first note that all market makers except two (Mitsui and Société Générale) and all clearing members of the London Bullion Market Association (LBMA) are presently APs of GLD.Inventory Financing

Consider a company whose operation requires an expensive inventory. In order to stay in the realm of the gold market, this might be a large coin store, a refiner or mint, or even the market maker of a public exchange. The regular operation requires a considerable gold inventory, but this inventory ties up a lot of capital.In order to reduce the capital requirement, our company has several options, for example,

- To take out an unsecured loan in order to finance the inventory. This is usually an expensive strategy.

- To Take out a loan for which the inventory serves as the collateral. Given that the inventory is gold bullion, the collateral is easy to liquidate, and so the interest expenses on such a loan should be a significantly lower than those on an unsecured loan.

- To swap the gold for dollars with a bullion bank, i.e. our company borrows dollars from the bank and at the same time lends gold to the bank, both for a fixed term. This is almost the same as taking out a loan that is secured by the gold. Since such swaps are typically limited to 400oz LGD bars, this method is suitable for the market maker, but not for the coin dealer or for the refiner.

- To give private investors an opportunity to own a part of the inventory. The pooled accounts offered by Kitco or by the Perth Mint are examples of this type of inventory financing. Our company can sell the title to gold that forms part of the inventory, to private investors and offer to buy it back from them. Such a pooled account is indeed backed by physical gold, but this is the physical gold that flows through our inventory anyway. Voila, somebody else owns our inventory, and our capital is no longer tied up in order to hold this very inventory.

Even better, should the portion of the inventory corresponding to this flow decrease unexpectedly, they can even purchase a basket of GLD shares in the market, redeem them and recover the gold at any time. In this sense, GLD is even superior to the Kitco pooled account. Kitco can decrease their inventory only if some of the investors in their pooled account decide to sell. GLD offers the advantage that there is a liquid market for GLD shares from which the bullion bank can purchase additional shares at any time. The average daily trading volume of GLD is about 12 million shares which represents an inventory of 1.16 million ounces or 36.2 tonnes.

Reserve Management

A second use of GLD for the bullion bank besides the financing of a part of their inventory is reserve management. This plays a role for every institution that accepts bank deposits in ounces, that lends ounces and that holds only a fractional reserve of physical gold against this created credit. For example balance sheets, we refer to Bullion Banking with Alice and Bob.The bullion bank can hold gold instruments in various forms, for example,

- physical gold in the vault,

- allocated balances with other institutions,

- shares of GLD,

- unallocated balances with other institutions,

- outstanding loans denominated in ounces,

- long OTC Forward or COMEX futures positions,

- and many others.

Besides the credit risk, i.e. the risk that a counterparty fails to honour its obligations, any bullion bank that holds only a fractional reserve against their customers’ deposits, is exposed to liquidity risk. For example, customers might request allocation of their unallocated account balances. In this case, both a liability of the bank (the customers’ unallocated account balance) and an asset (a reserve of physical gold) disappear from the balance sheet. This is analogous to a customer withdrawing dollars in cash from a commercial bank or to a customer transferring out credit money from her account.

Since such a withdrawal involves a reduction of our bullion bank’s reserves, our reserve ratio deteriorates. We now have less reserves relative to the size of our balance sheet. This is where GLD comes in handy. We can easily replenish our reserves by

- selling unallocated gold or other instruments that involve credit or counterparty risk, and

- purchasing shares of GLD, and optionally

- redeeming these shares for physical gold.

Shortage of Reserves and Reduction of GLD Inventory

Although inventory financing may be one of the motivations for establishing GLD and for the APs to place additional gold in GLD, it is not the activity that correlates with the inventory changes on which our trading strategy is based. The reason is that our strategy is based on the creation and redemption of GLD baskets, but inventory financing occurs when a bullion bank sells existing shares of GLD to an investor.Let us try to disentangle these steps. The bullion banks presumably hold a part of their reserve in the form of physical gold in their own vault and another part in the form of GLD shares. Whenever they acquire a larger amount of additional physical reserves, they probably place some of it into GLD and create new baskets of shares, but they do not necessarily sell these GLD shares to investors and even if they do, this need not happen at the same point in time.

Conversely, if a bullion bank faces a large allocation request and needs to replenish the physical gold in their vault, they can redeem baskets of GLD that they already own. In a true emergency in which a bullion bank runs out of reserves, they can even

- sell some paper gold, and

- purchase GLD shares with the proceeds, and optionally

- redeem these GLD shares in order to receive physical gold,

Since our trading strategy uses only the instances in which shares of GLD are redeemed for physical gold, it is sensitive to the following two situations:

- The bullion bank has purchased shares of GLD in order to boost its reserves. In order to achieve a balance between their two forms of reserves, i.e. GLD and physical gold in the vault, they redeem some of these GLD shares.

- There has been a request for allocation by some investor who requires individual bars in the vault, and so GLD shares need to be redeemed in order to get to the bars.

One of the largest recent reductions in GLD inventory occurred on 22 May 2012 with a net redemption of 563024 ounces, i.e. 58 baskets or about 17.5 tonnes. This event coincides up to one week with a negative one-month GOFO quoted by J.P. Morgan on 16 May 2012 as reported by Izabella Kaminska. This indicates that J.P. Morgan was presumably willing to pay a premium in order to swap dollars for gold, i.e. they were willing to buy at spot and sell a one-month forward at a discount.

Robert LeRoy Parker spotted another example. Some of the largest reductions in GLD inventory occurred on 23 and 24 August 2011 with redemptions of 798417 ounces and 876288 ounces, together 172 baskets or about 52 tonnes of gold. This coincides with the following reported Gold Forward Offered Rates (GOFO) found on the LBMA website at that time. The numbers are GOFO for 1,2,3,6 and 12 months:

19-Aug-11 0.40000 0.41600 0.42600 0.48800 0.51000The term structure beyond one month was inverted on 22 August 2011, indicating that some bullion bank(s) frantically tried to borrow gold in the OTC market, gold that was needed within one to two months. They were willing to buy one-month forward and sell a longer forward at a discount. Recall that the GOFO rates reported on the LBMA website are not individual quotes that can be associated with a specific bullion bank, but rather the averages from their daily telephone survey of the major market makers. Also note that a few days later, these numbers were ‘corrected’ on the LBMA website.

22-Aug-11 0.48250 0.43000 0.35000 0.25000 0.08750

23-Aug-11 0.40800 0.41600 0.42250 0.50000 0.52600

A third example was again reported by Izabella Kaminska. On 10 August 2011, Société Générale quoted an inverted term structure:

Again, this coincides with losses of GLD inventory of 418373 ounces on 9 August 2011, 759559 ounces on 11 August 2011 and 408988 ounces on 12 August 2011, together 1.59 million ounces, 164 baskets or 49.3 tonnes. Since Société Générale is not an AP, apparently someone else took the gold out of GLD and lent it to them.

We have to concede that the published GLD inventory only records the aggregate daily changes. The fax from HSBC that Warren James at Screwtape Files discovered, shows redemptions of 759618 ounces for 16 August 2011. This must have been some intra-day movement that was compensated by even larger creations on the same day because the reported aggregate change of inventory for that day is positive. Apparently the inventory changes are such a good indicator that the trading strategy is still effective even if we work with daily aggregates only.

Interpretation

We arrive at the interpretation that large allocation requests by customers of a bullion bank sometimes force the bullion bank to take physical gold out of GLD. This is a buy signal that indicates a higher price of paper gold in the near future. Conversely, once the bullion bank has replenished its reserve of physical gold and shifts a part of this back into GLD, this forms a sell signal that indicates a less rapidly increasing price of paper gold in the near future.FOFOA must have had this picture in mind when he called GLD the Central Bank of the Bullion Banks, i.e. a depository of additional reserves shared by those bullion banks that are at the same time APs.

It remains to understand why the paper price of gold rises during the period immediately following strong demand for physical gold.

Conservative Interpretation

A simple explanation is the following. Many large redemptions of GLD occur towards the end of a sell-off in the price of paper gold. There might be some sophisticated buyer(s) of physical gold who buy the dips and whose timing is excellent.Notice that the buyer(s) purchase only about 5 to 50 tonnes of physical gold on the relevant days whereas about 2700 tonnes of paper gold are sold every trading day (total transaction volume of all sales, assuming 62.5 trading days per quarter) according to the Loco London Liquidity Survey published in August 2011. Although the physical purchase is tiny compared to the trading volume of paper gold, after this purchase the price of paper gold increases.

We might attribute this to the excellent timing of the large physical buyer whose activity we can sometimes spot by watching the inventory of GLD.

Speculative Interpretation

If you find this interpretation unsatisfactory and ask why should the paper price increase after the purchase of an amount of allocated gold that is small compared to the volume of paper gold traded, the only way out is more speculative.What if somebody manages the price of paper gold in such a way as to control the flow of physical gold? The following chart shows the remarkably uniform increase in the dollar price of gold over the previous decade from 2002 to 2011. The black line is the regression line in the logarithmic diagram. It starts on 2 January 2002 at $266.60 and ends on 29 December 2011 at $1589.95 for an annual rate of increase of 19.56%. The blue and light blue bands are a factor of 1.118 and 1.25 away from the black line.

Does this chart look ‘managed’? Maybe…

How would one manage the price in such a way as to control the flow of physical gold? Let us make up some numbers in order to arrive at a toy model. There is a flow of new gold into the market from mining and recycling. This amounts to about 3000 tonnes per year. If a third of this amount goes through the London market, this amounts to about 4 tonnes per trading day (assuming 250 trading days per year).

In addition, there are some investors who sell allocated gold and some who purchase allocated gold. Let us be generous and assume that this trading volume of allocated gold is three times as big as the flow of new gold. This suggests a trading volume of 16 tonnes of physical gold per trading day in the London market which is tiny compared to the trading volume of paper gold (2700 tonnes per trading day). It is important to keep in mind that the inflow of new gold has an approximately constant weight per day.

It firstly seems plausible that allocation requests of about 5 to 50 tonnes are big enough in order to affect the reserve management of the bullion banks and thereby result in changes to the GLD inventory. It is also plausible that the management of the physical reserve that underlies the gold market is a rather delicate business because the paper trading volume is so huge compared to the physical volume.

Secondly, let us assume that the allocation requests by the buyers of physical gold involve an approximately constant sum of dollars per time. Investors or central banks who gradually switch from dollars into gold or who gradually diversify their foreign exchange reserves. We therefore have an inflow of physical gold that is steady in terms of weight per time, but an outflow that is steady in terms of dollars per time.

In order to manage the flow of physical gold, someone might therefore try to manage the dollar price of paper gold. Since the physical inflow is by weight, but the outflow by dollars, one might try to increase the paper price in response to an increased outflow of physical gold and try to lower the paper price whenever there are plenty of reserves. There you go. This is indeed consistent with what we see in our trading strategy: The price of paper gold increases in response to an outflow of physical gold.

Let us keep this speculation in mind as a second possible explanation of why the trading strategy works.

In light of this interpretation, it would be worthwhile watching the total inventory of GLD (the blue curve, right scale, in the very first diagram of this article). The inventory of GLD, the central bank of the bullion banks, should move in line with their total physical reserves. We see that the inventory peaked at 42.1 million ounces (1310 tonnes) in summer 2010, a level that has not been reached ever since. Even though the dollar price of gold rose further from $1200/ounce to $1900/ounce, the investors in GLD were not able to entice the APs to make additional inventory available.

Nevertheless, the present GLD inventory of still 40.84 million ounces (1270 tonnes) forms a considerable reserve of physical gold which the bullion banks can draw on in order to replenish their own reserves. Should the total inventory continue to decline, this would indicate increasing pressure on the physical reserves of the bullion banks. The financial media, however, would presumably tell you that investors are no longer interested in gold, that they sold their shares in GLD and that this was bearish for gold. Nothing would be further from the truth.

The SLV Inventory Strategy

The same trading strategy that we developed for gold, can also be applied to silver. We therefore watch the inventory of the iShares Silver Trust (SLV) whose inventory management is organized in the same way as that of GLD. Note that a share of SLV presently represents about 0.97 ounces of silver. One basket consists of 50000 shares, i.e. about 1.5 tonnes of silver presently worth $1.37 million (London silver fixing of $28.25/ounce on 29 May 2012).The following histogram shows the distribution of the daily changes to the inventory of SLV.

Distribution of daily SLV inventory changes in millions of ounces from 1 January 2007 to 30 April 2012

The following chart finally shows the performance of this strategy. The black curve (left scale) is the London Silver Fixing in U.S. Dollars. Again, buy and sell signals are indicated by green and red dots, respectively, and the light-blue shaded areas are the times during which the strategy is invested, i.e. about 25% of the time. During the invested periods, the silver price increases at an annualized rate of 28.7% whereas during the remaining times it increases only at an annualized rate of 11.6%. The blue curve (right scale) finally shows the total inventory of SLV.

Whereas in the case of GLD, basically any threshold beyond our 250000 ounces works, as long as it gives a sufficient number of signals at all, it is substantially more difficult to find efficient parameters for the strategy involving SLV and silver. Nevertheless, we do have an effective trading strategy, and so everything said about reserve management and GLD seems to apply to silver and SLV, too.

Comments

If you have comments, suggestions or corrections concerning this article, please comment here (comments are moderated, and it may take a while until I have time to check for new comments). FOFOA just opened a new thread GLD Talk Continued, and so for the further discussion, please take a look there.http://victorthecleaner.wordpress.com/2012/06/01/gld-the-central-bank-of-the-bullion-banks/

Tuesday, May 1, 2012

$20 Pure Silver Commemorative Coin - Diamond Jubilee (2012)

Mintage

Limited to 250000 coins worldwide

Composition

fine silver (99.99% pure)

Finish

specimen

Weight (g)

7.96

Diameter (mm)

27

Edge

serrated

Certificate

not serialized

Face value

20 dollars

Artist

Laurie McGaw (reverse), Mary Gillick (obverse)

Thursday, April 19, 2012

Wednesday, April 18, 2012

Remint of Silver Kookaburra 1992

Perth Mint re-minting silver Kookaburra up to max mintage of 300,000

Available now at LPM

http://www.lpm.hk/product-details.aspx?id=159116

Perth Mint 1oz Kookaburra Coins

Year Max Mintage Actual Mintage Difference

1990 300,000 300,000 0

1991 300,000 278,136 21,864

1992 300,000 195,118 104,882

1993 300,000 165,406 134,594

1994 300,000 153,414 146,586

1995 300,000 131,411 168,589

1996 300,000 146,286 153,714

1997 300,000 147,781 152,219

1998 300,000 91,550 208,450

1999 300,000 98,513 201,487

2000 300,000 93,238 206,762

2001 300,000 158,969 141,031

2002 300,000 76,245 223,755

2003 300,000 86,737 213,263

2004 300,000 74,059 225,941

2005 300,000 80,336 219,664

2006 300,000 73,765 226,235

2007 300,000 197,229 102,771

2008 300,000 300,000 0

2009 300,000 300,000 0

2010 300,000 300,000 0

2011 500,000 500,000 0

Available now at LPM

http://www.lpm.hk/product-details.aspx?id=159116

Perth Mint 1oz Kookaburra Coins

Year Max Mintage Actual Mintage Difference

1990 300,000 300,000 0

1991 300,000 278,136 21,864

1992 300,000 195,118 104,882

1993 300,000 165,406 134,594

1994 300,000 153,414 146,586

1995 300,000 131,411 168,589

1996 300,000 146,286 153,714

1997 300,000 147,781 152,219

1998 300,000 91,550 208,450

1999 300,000 98,513 201,487

2000 300,000 93,238 206,762

2001 300,000 158,969 141,031

2002 300,000 76,245 223,755

2003 300,000 86,737 213,263

2004 300,000 74,059 225,941

2005 300,000 80,336 219,664

2006 300,000 73,765 226,235

2007 300,000 197,229 102,771

2008 300,000 300,000 0

2009 300,000 300,000 0

2010 300,000 300,000 0

2011 500,000 500,000 0

Subscribe to:

Posts (Atom)